In the update video for this month, I discuss what is driving equity markets to new all-time highs here and in the US. A trade deal is being priced in but there is is still a long way to go, while central banks around the world are pumping money into the system again. Closer to… [Read More]

Your Resources

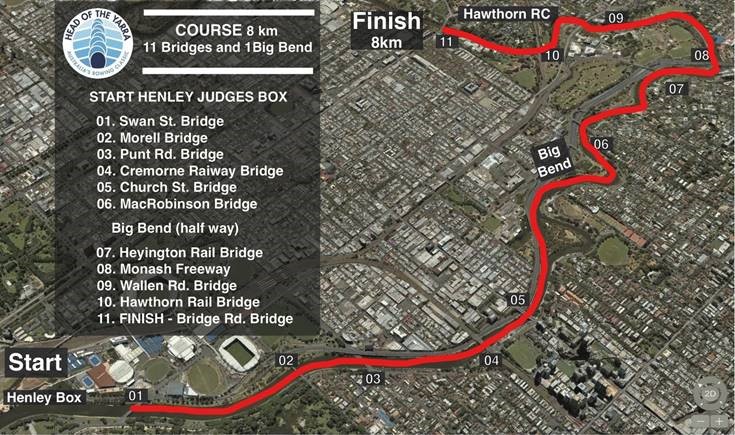

Head of the Yarra – Rowing Against Domestic Violence

On 30 November 2019, my rowing crew, Leichhardt Rowing Club’s Harpoons, will be participating in the “Head of the Yarra” Regatta in Melbourne. It’s a gruelling 8.6km time trial regatta for coxed eights! The course winds from within the heart of Melbourne to the Hawthorn Rowing Club navigating through 11 bridges and some serious hairpin… [Read More]

Investment Spotlight – Kallium Lakes Solphate of Potash

As an investor with us, you will be familiar with the story behind Kallium Lakes (ASX: KLL). We have been following Kallium for almost a year now as their Beyondie Sulphate of Potash (SOP) project in Western Australia progressed through the final stages of feasibility to be fully funded, with construction now in full swing. … [Read More]

October Message from Rob Gilmour

In the update video for this month, I discuss markets as we see a race to the bottom with central banks cutting interest rates and the lingering uncertainty being caused by the US / China trade war that is dragging down global growth. Closer to home, the recently announced review into retirement income will no… [Read More]

Cutting interest rates is not the answer!

Low interest rates and making borrowing easier are not the panacea to our slowing economic growth. As a large community of workers from the baby boomer generation retire, they reduce their spending. Overall economic activity will naturally slow when there is not an offsetting level of consumption elsewhere in the economy. The next largest generation… [Read More]

Investment Spotlight – Successful Exit for our Student Accommodation Fund

Overview In early 2016 we made an investment across several client portfolios in the BlueSky Student Accommodation Fund III. This was a direct investment for wholesale/sophisticated investors in the development and construction of a purpose built student accommodation building at 48 La Trobe Street in Melbourne. The project was to develop a premium 793 bed… [Read More]